KNOW YOUR RIGHTS

Essential workers have the right to protect themselves and their families.

Coronavirus spreads mainly from person to person. Employers on construction job sites are required to implement CDC guidelines and follow New York State health and safety orders to protect workers and to reduce transmission among employees.

Employers are prohibited by law from retaliating against workers expressing concerns.

To report unsafe conditions, file a confidential claim with the New York State Attorney General’s office by calling (212) 416-8700, press 9. You can also send an email to labor.bureau@ag.ny.gov.

Your employer’s priority must be to protect your health and safety.

Best Practices for Employers to keep worksites safe

-

Employers must provide proper Personal Protective Equipment (PPE), such as N95 respirators, gloves and glasses.

-

Handwashing stations and disinfection procedures must be implemented.

-

Social distancing must be enforced in elevators and during lunch breaks.

-

Employers must actively encourage workers who feel sick to stay home and cannot be penalized for refusing to work.

FINANCIAL RESOURCES

The COVID-19 pandemic is beginning to have devastating impacts on our economy and on working-class families. Federal, State and Local governments are stepping in to provide immediate relief to workers.

Below are Hardship Assistance and Relief Funds resources:

Access to Unemployment

NYS Governor Andrew Cuomo ordered immediate access to unemployment for workers who lost work due to the Coronavirus. The 7-day waiting period has been waived.

To that end, the DOL is implementing a new more efficient filing system based on the first letter of the applicant’s last name (alphabetical order).

- A – F : Monday

- G – N : Tuesday

- O – Z : Wednesday

- Missed your day: Thursday and Friday

Filing later in the week will not delay payments or affect the date of an individual’s claim, since all claims are effective on the Monday of the week in which they are filed.

DOL is also extending filing hours as follows:

- Monday through Thursday 8 am to 7:30 pm.

- Friday 8:00 am to 6:00 pm.

- Saturday 7:30 am to 8:00 pm.

If you have lost work due to COVID-19, you can file claims on the Department of Labor’s website: https://applications.labor.ny.gov/IndividualReg/

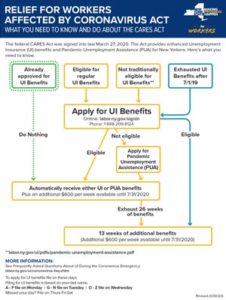

The federal Coronavirus Aid, Relief and Economic Security (CARES) Acts enhanced Unemployment Insurance benefits and Pandemic Unemployment Assistance. Find out more about how to apply and if you qualify NYS Department of Labor.

Economic Impact Payments

The federal Coronavirus Aid, Relief and Economic Security (CARES) Act created a one time payment to most households. On March 30, the Treasury Department and the Internal Revenue Service (IRS) announced that distribution of economic impact payments will begin in the next three weeks and will be distributed automatically, with no action required for most people. Social Security beneficiaries who are not typically required to file tax returns will not need to file an abbreviated tax return to receive an Economic Impact Payment. Instead, payments will be automatically deposited into their bank accounts.

You can read the IRS FAQ on the program and check this IRS website for ongoing updates on coronavirus tax relief.

You can visit the IRS’s website for further and updated information on the IRS’s response to coronavirus and a list of available relief programs, which include payment plans for eligible borrowers.

NYC Property Tax Relief

The New York City Department of Finance offers several programs to assist property owners who face hardships making their property tax payments. These include exemption programs to lower the amount of taxes owed, standard payment plan options (the terms of which are individualized) as well as the new Property Tax and Interest Deferral (PT AID) program, for those who qualify.

To qualify for PT AID you must be a NYC resident, owner of a 1- to 3-family home or condo, earn $58,399 or less per year and have fallen behind or are in danger of falling behind in paying your property taxes. If you are experiencing a temporary loss of income resulting from an extenuating circumstance such as a job loss or death in the family, you may wish to apply for an extenuating circumstances income-based payment plan. Under this plan, you can get caught up on your property taxes over a short period of time, until your financial situation improves.

To determine your eligibility and apply visit the Department of Finance website about Standard Payment Plans or PT AID.

Tax Relief

Federal Tax Relief

The 2019 income tax filing and payment deadlines for all taxpayers who file and pay their Federal income taxes on April 15, 2020, are automatically extended until July 15, 2020. This relief applies to all individual returns, trusts, and corporations. This relief is automatic, taxpayers do not need to file any additional forms or call the IRS to qualify. This relief only applies to federal income returns and tax (including tax on self-employment income) payments otherwise due April 15, 2020, not state tax payments or deposits or payments of any other type of federal tax.

You can visit the IRS’s website for further and updated information on the IRS’s response to coronavirus and a list of available relief programs, which include payment plans for eligible borrowers.

NYC Property Tax Relief

The New York City Department of Finance offers several programs to assist property owners who face hardships making their property tax payments. These include exemption programs to lower the amount of taxes owed, standard payment plan options (the terms of which are individualized) as well as the new Property Tax and Interest Deferral (PT AID) program, for those who qualify.

To qualify for PT AID you must be a NYC resident, owner of a 1- to 3-family home or condo, earn $58,399 or less per year and have fallen behind or are in danger of falling behind in paying your property taxes. If you are experiencing a temporary loss of income resulting from an extenuating circumstance such as a job loss or death in the family, you may wish to apply for an extenuating circumstances income-based payment plan. Under this plan, you can get caught up on your property taxes over a short period of time, until your financial situation improves.

To determine your eligibility and apply visit the Department of Finance website about Standard Payment Plans or PT AID.

Mortgage Grace Period

Mortgage Relief. Gov. Cuomo has required New York State regulated financial institutions to provide residential mortgage forbearance on property located in New York for a period of 90 days to any individual residing in New York who demonstrates financial hardship as a result of the COVID-19 pandemic. Regulated financial institutions include Bank of New York Mellon, Goldman Sachs Bank USA, M&T Bank, New York Community Bancorp and Signature Bank. Lenders have been directed to make available to customers how to apply for COVID-19 relief. Additional information assistance can be found on the Department of Financial Services (DFS) website or by calling the DFS at 1-800-342-3736.

Foreclosures Postponed or Suspended. Gov. Cuomo also announced he will be postponing or suspending foreclosures for three months for eligible homeowners. For help determining your eligibility, call the Department of Financial Services at 1-800-342-3736.

Some Banking Fees Waived. New York State regulated banks will also temporarily waive fees for overdraft, ATMs and credit cards late payments for individuals with a demonstrated financial hardship.

Housing

Please check the links provided to confirm your eligibility.

Mortgage payment forbearance for homeowners with mortgages backed by the FHA, USDA, VA, HUD Section 184a, Fannie Mae, or Freddie Mac

The Coronavirus Aid, Relief, and Economic Security (CARES) Act provides relief for homeowners with government-guaranteed mortgages. Homeowners with mortgages backed by the FHA, USDA, VA, HUD Section 184a, Fannie Mae, or Freddie Mac are eligible for loan forbearance for up to one year without fees, penalties, or additional interest. Homeowners who are facing a financial hardship, either directly or indirectly, from the coronavirus may receive the forbearance by submitting a request to their servicer stating they are experiencing a hardship related to the virus. The forbearance will be granted for 180 days and may be extended for up to another 180 days at the borrower’s request.

Homeowners in need of the forbearance should reach out to their mortgage servicers as soon as possible or contact a HUD approved housing counselor. Contact information for a homeowner’s mortgage servicer can be found in monthly mortgage statements or coupon book. The nearest housing counselor can be found at www.consumerfinance.gov/find-a-housing-counselor or by calling (800) 569-4287.

Homeowners with FHA, USDA, VA, or Section 184 or 184A mortgages, or mortgages backed by Fannie Mae and Freddie Mac, who are facing foreclosure will also have relief from foreclosure or being forced to relocate as we address the COVID-19 pandemic. The foreclosure eviction moratorium is in effect until May 17, 2020.

Eviction Protection

The Right to Counsel has created an English and Spanish language Eviction Moratorium FAQ.

In NYC, all city marshals have been notified that they can not execute any pre-existing warrants. If they attempt to violate this, please report this activity by calling the City’s Department of Investigation (DOI) Bureau of City Marshals at (212) 825-5953.

In NYC, you can also call Housing Court Answers, 9am-5pm, Monday-Friday: 212-962-4795 or 718-557-1379. Calls are answered directly in Spanish, English and French, and interpreters are used for all other languages through the LanguageLine translation service.

Statewide hotline: 833-503-0447, open 24/7. They will soon be able to answer questions in all languages with interpreters. This is a referral line only — hotline workers aren’t able to answer specific legal questions, but they will be able to direct you to the courts, clerks offices and other resources in your region. If you don’t get through the first time, keep trying!

NYCHA Tenant Help

Households that experience a complete loss of income may qualify for NYCHA’s Zero Policy.

If a household reports zero income, they will participate in an interview with NYCHA House Assistance and will complete a Zero Income Questionnaire. The interview can be held over the phone. If you need further assistance, please call your property management office or Customer Contact Center at 718-707-7771.

A household may qualify for a rent reduction based on rent hardship if all the following conditions are met:

- There is at least a 5% reduction to gross income

- Current rent is more than 30% of the net household income

- Reduction in income has lasted at least two months

Residents can request a rent reduction through an Interim Recertification, which is a change in a household’s income that occurs between Annual Recertification periods.

Residents can initiate an Interim Recertification via the NYCHA Self-Service Portal or by requesting a paper form at their Management Office (which will be mailed to the resident’s home address).

Completed paper forms and copies of the required supporting documents should be mailed to: New York City Housing Authority, PO Box 19202, Long Island City, NY 11101.

Click below a list of supporting document that must be submitted with the Interim Recertification:

Domestic violence

In an emergency, dial 911. Call the NYC Domestic Violence and Sexual Assault Hotline at 800-621-4673, TTY 866-604-5350 (if you’re hearing impaired) to speak with a counselor. Learn more about how Family Justice Centers can help.

Risk of homelessness

Homebase will help you develop a plan to overcome an immediate housing crisis and achieve housing stability. Call 311 to find out how Homebase can help and learn more from HRA.

Section 8

NYC Housing Preservation and Development (HPD) Section 8 voucher holders having trouble paying rent because of income loss should email DTRAI@hpd.nyc.gov.

Rent Arrears and Public Assistance

If your work schedule was reduced as a result of the coronavirus and you are unable to pay your rent, you can apply for a Cash Assistance special grant request to get benefits for emergencies.

- If you have an active Cash Assistance case, the fastest way to submit your request is online on ACCESS HRA.

- Call HRA Info line at 718-557-1399 to learn how to apply by mail

Utilities

-

Utilities have voluntarily agreed to suspend shut-offs for nonpayment for gas and electric in New York State.

Internet

Price Gouging

- To report price gouging in NYS, consumers can fill out a Consumer Complaint Protection Form.

- When reporting a Coronavirus Price Gouging related complaint, be prepared to provide details including: location of the merchant, any proof of excessive price(s) (receipts or pictures), and the company information. In “complaint description” include dates and information that demonstrates a price increase.